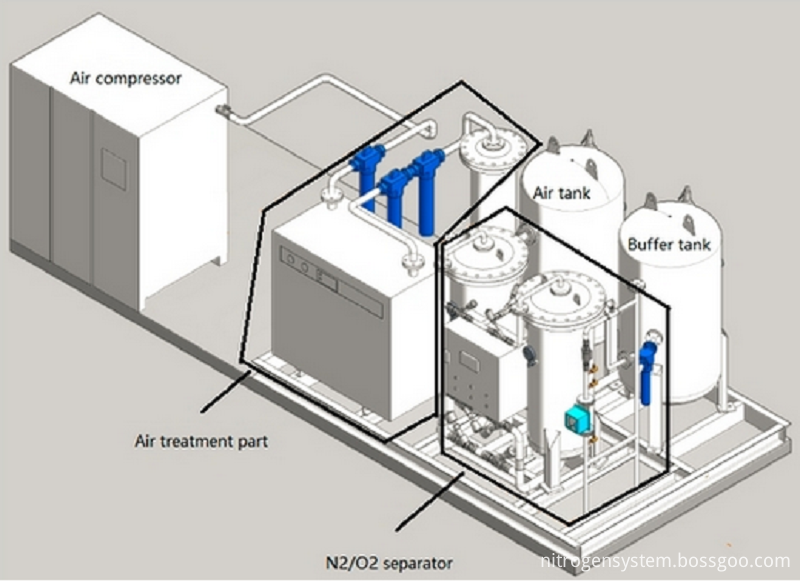

Skid Nitrogen Generator is installed on one skid, it has compact structure, easy for ocean transportation, no need for site installation. When machine reach site, just need to put the machine on flat ground, connect power and gas pipeline, then one simple push on starting button makes the Nitrogen Generator begin to work. Its structure is as below:

From above drawing, it is clear that skid nitrogen generator has Air Compressor, air treatment part, air tank, nitrogen separator and nitrogen buffer tank. It has the following features:

Compact structure, easy installation;

Flow rate, purity adjustable;

Intelligent fully automatic operation;

Energy-saving operation;

Skid nitrogen generator photos

Skid Nitrogen Generator Skid Nitrogen Generator,Nitrogen Generator,Nitrogen Generation,Nitrogen Generation System Shandong Gamma Gas Engineering Co. Ltd. , http://www.gammagas.com

U.S. consulting firm PricewaterhouseCoopers recently stated that global industrial M&A activity continues to be active. The company's statistics show that in the first half of this year, Global Industry announced 374 M&A transactions. At the current pace, the number of M&A transactions in global industries this year will be less than 839 in 2007, but it is still possible to reach 759 in 2006.

PricewaterhouseCoopers said that the number of global industrial M&A deals this year is showing rapid growth, and the number of transactions announced in the second quarter is almost double that in the first quarter. In M&A transactions with transaction value exceeding 50 million U.S. dollars, the average value of each M&A transaction in the second quarter was 340 million U.S. dollars, which was significantly lower than the average transaction value of 545 million U.S. dollars in the first quarter.

Saverio Fato, head of global chemical business at PricewaterhouseCoopers, said: "The first half of 2008 + global industrial M&A was the same as we saw in times of economic uncertainty, with more chemical companies It is hoped that the disadvantaged situation will be changed through mergers and acquisitions, and more conservative transactions will take place."

In addition, mergers and acquisitions tend to be large-scale, and the funds are frequently worth billions of dollars. On January 2, 2008, the Dutch chemical giant AkzoNobel completed the acquisition of ICI, a British paint manufacturer. The acquisition price was 8 billion pounds (16.2 billion U.S. dollars). In the second quarter of this year, Hexion Specialty Chemicals unilaterally announced the cancellation of its mergers and acquisitions with Huntsman. This casts a shadow over the prospects of global industrial M&A transactions, but then two consecutive large-scale mergers and acquisitions have taken place in the globalization industry. Transaction: On July 10th, Dow Chemical Company announced that the company had agreed to acquire Rohm and Haas Company for US$18.8 billion; on July 11, Ashland Inc. and Hex Company entered into a merger and acquisition agreement with Heklis was bought at a price of $3.3 billion, and the transaction also included net debt of $700 million.

Fei Tai believes that under such current economic and industrial conditions, such large-scale chemical M&A transactions take place because chemical companies are still keen to adopt mergers and acquisitions to improve their situation in the entire industry, resulting in drastic raw material prices. Volatility and weak market demand occupy a favorable market position.

PricewaterhouseCoopers also stated that current financial investors’ confidence in chemical M&A transactions began to recover, and its share of global chemical M&A transactions has increased from 10% in the first quarter to 20% in the second quarter. However, it is still lower than the average level in 2006 and 2007, which was 26% in 2006 and 21% in 2007.

Judging from recent mergers and acquisitions, the global chemical M&A market is shifting from the United States and Europe to other regions of the world such as Asia. New York-based investment bank Young & Partners (Y&P)'s latest analysis shows that in the first half of the year, chemical mergers and acquisitions that took place in other parts of the world, such as Asia, accounted for about 41% of global chemical M&A transactions, compared with 35% in Europe. The United States is 24%. In 2007, chemical mergers and acquisitions in other parts of the world, such as Asia, accounted for about 23% of the total global chemical M&A transactions, compared with 47% for Tianzhou C and 30% for the United States.

According to Peter Young, president of Y&P, “The global chemical M&A market has undergone tremendous changes in the first half of this year; Asia and other parts of the world surpassed the United States and Europe to become the world’s largest chemical M&A market for the first time.†He pointed out that Asia Pacific and the Middle East It is the main driving force for the growth of global chemical M&A transactions. The chemical industries in these two regions have already passed the most optimistic stage. Currently, M&A deals are actively being carried out to become bigger and stronger.

Global chemical mergers and acquisitions show new features

In a report to customers last week, Bennett Patel, a Goldman Sachs economic expert based in London, said that half of the world’s economies are facing a recession since the credit crisis erupted. This wave of economic recession is seriously affecting the chemical industry. Producers are resorting to all the difficulties to tide over the difficulties. Mergers and acquisitions have also become one of the strategies to change the unfavorable situation. The number of global chemical M&A transactions has been growing rapidly, and mergers and acquisitions tend to be large-scale, with the focus shifting to Asia.